Why Negative Balances Increase

Editor's Note: Negative Balance Increases: Understanding The Causes And Consequences was last published on August 8, 2023.

With the recent economic downturn, many people are finding themselves with negative bank balances. This can be a very stressful situation, and it's important to understand the causes and consequences of negative balance increases.

We've done some analysis and digging, and put together this guide to help you understand negative balance increases. We'll cover the causes and consequences of negative balance increases, and we'll also provide some tips on how to avoid them.

Key Differences:

| Cause | Consequence |

|---|---|

| Overspending | Late fees |

| Insufficient funds | Overdraft fees |

| Identity theft | Damaged credit |

Main Article Topics:

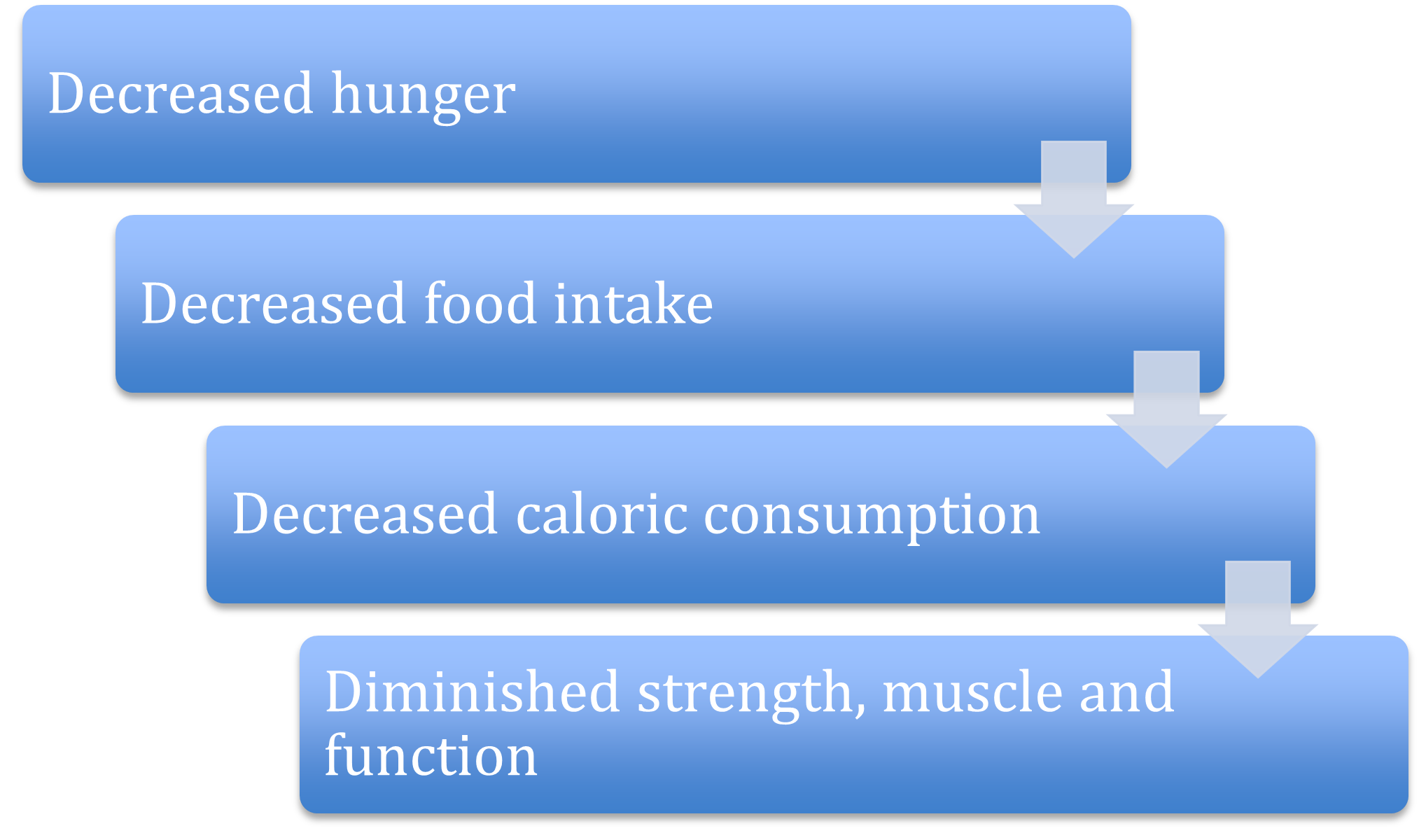

SARCOPENIA: CAUSES, CONSEQUENCES AND PREVALENCE. UNDERSTANDING AN UNMET - Source journal.parker.edu

FAQs: Negative Balance Increases – Understanding Causes and Consequences

Negative balance increases can occur when the amount of money owed exceeds the available balance in a financial account. Understanding the causes and consequences of these increases is crucial for financial management. This FAQ section aims to address common questions and provide a comprehensive understanding of the subject.

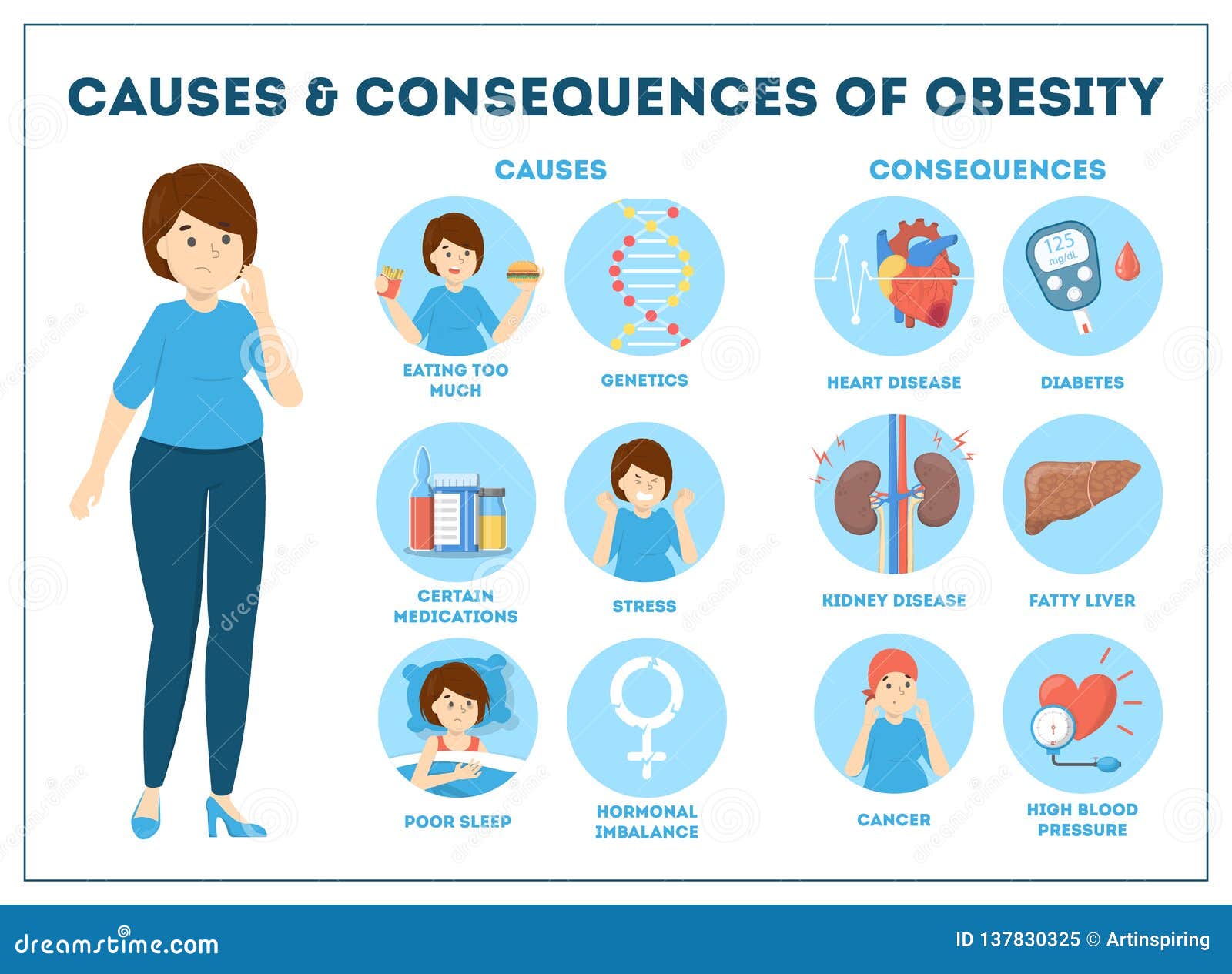

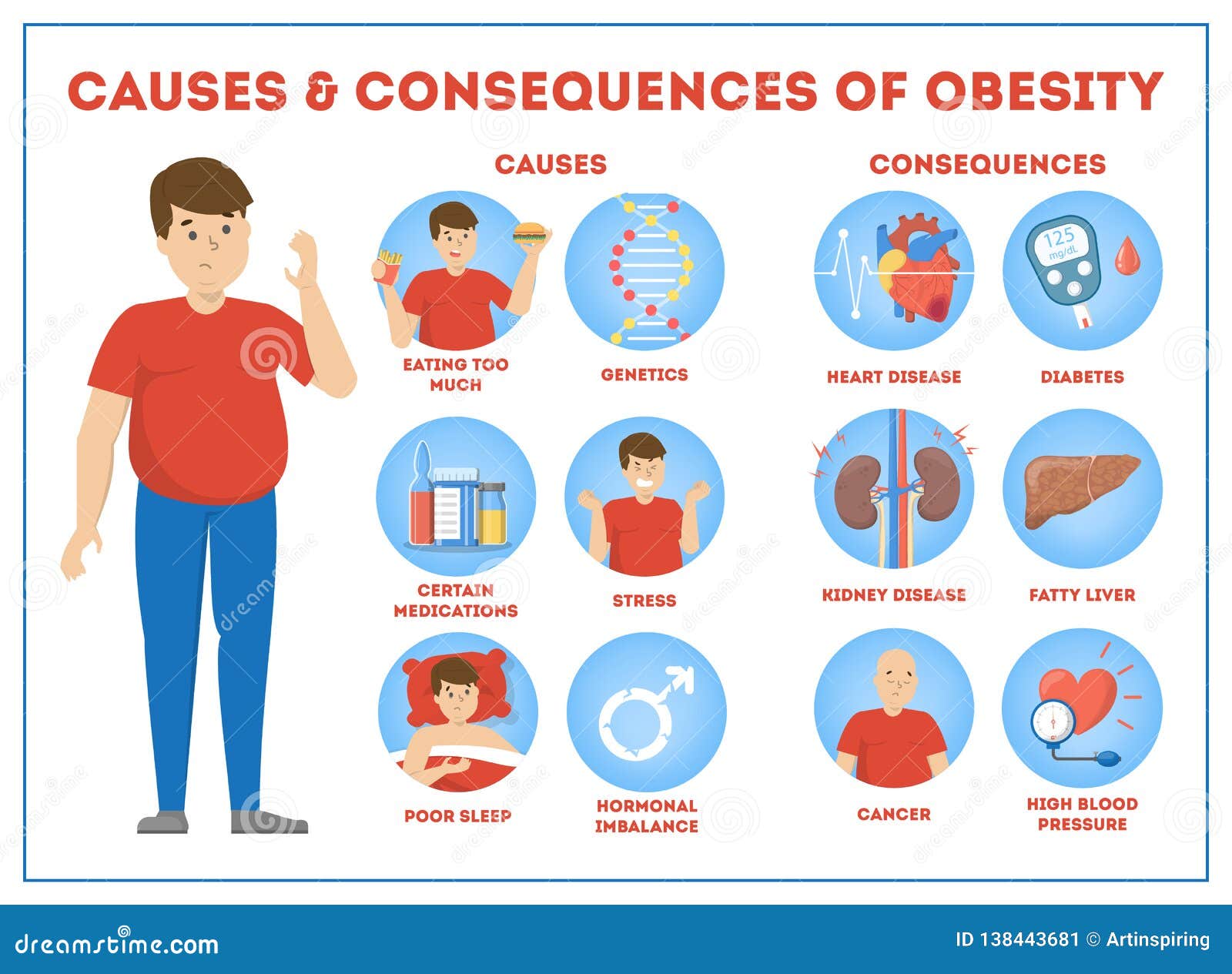

Obesity Causes and Consequences Infographic for Overweight Stock Vector - Source www.dreamstime.com

Question 1: What are the primary causes of negative balance increases?

Negative balance increases can arise due to various factors, including overdrafts, unauthorized transactions, account fees, or errors in account management. Overdrafts occur when an individual spends more money than the available balance, resulting in a negative account balance. Unauthorized transactions can involve fraudulent activities or errors in processing payments. Account fees and charges, such as overdraft fees or monthly maintenance fees, can also contribute to negative balances.

Question 2: What are the potential consequences of a negative balance increase?

Negative balance increases can have significant consequences, including additional fees and charges, damage to credit score, and difficulties in accessing financial services. Banks and financial institutions usually impose overdraft fees for negative balances, which can accumulate rapidly. Overdue payments can also lead to late fees and penalties. Furthermore, a history of negative balance increases can negatively impact credit scores, making it more challenging to obtain loans or secure favorable interest rates.

Question 3: Can a negative balance increase affect other financial accounts?

In certain cases, negative balance increases in one account can have implications for other financial accounts. For example, if a linked account is used to cover the negative balance, it can also become overdrawn. Additionally, banks may share information about negative balance increases with credit reporting agencies, which can impact credit scores and limit access to financial products.

Question 4: How can negative balance increases be prevented?

Preventing negative balance increases requires proactive financial management. It is essential to track expenses and income diligently to ensure that spending does not exceed available funds. Regularly monitoring account statements and setting up account alerts can help identify unauthorized transactions or errors promptly. Choosing financial institutions that offer overdraft protection or low overdraft fees can also mitigate the impact of negative balance increases.

Question 5: What steps can be taken to address a negative balance increase?

Addressing a negative balance increase requires prompt action to minimize fees and protect credit. Individuals should immediately contact their bank or financial institution to report unauthorized transactions or errors and explore payment arrangements. Budgeting and expense reduction measures may be necessary to restore a positive account balance. Seeking credit counseling or financial assistance programs can provide support and guidance in managing debt.

Question 6: How can negative balance increases be distinguished from other financial difficulties?

Negative balance increases are a specific type of financial difficulty that arises from a negative account balance. They are distinct from other financial challenges, such as high levels of debt or insufficient income to meet expenses. However, negative balance increases can be a symptom of underlying financial difficulties, and addressing them may require a comprehensive financial plan.

Understanding the causes and consequences of negative balance increases is vital for responsible financial management. By implementing preventive measures, addressing issues promptly, and seeking professional assistance when needed, individuals can mitigate the impact of negative balance increases and maintain financial stability.

For more information on negative balance increases and related topics, please explore the following resources:

Tips

To avoid negative balance increases, a comprehensive understanding of the underlying causes and potential consequences is crucial. Implement these tips to prevent such situations and ensure responsible banking practices:

Anorexia stock illustration. Illustration of home, sarcopenia - 179340530 - Source www.dreamstime.com

Tip 1: Track expenses diligently: A clear overview of expenses helps to identify areas where spending exceeds income, allowing for necessary adjustments to avoid overdrafts.

Tip 2: Set spending limits: Establish realistic spending limits to prevent impulsive purchases and stay within financial boundaries.

Tip 3: Review bank statements regularly: Monitor transactions to detect unauthorized charges or errors that could lead to negative balances.

Tip 4: Use overdraft protection: Consider setting up overdraft protection to link a secondary account or line of credit to cover potential overdrafts.

Tip 5: Contact the bank immediately: In case of a negative balance, promptly contact the bank to discuss repayment options and avoid further consequences.

By following these tips and understanding the causes and consequences outlined in Negative Balance Increases: Understanding The Causes And Consequences, individuals can effectively prevent negative balance situations, maintain financial stability, and avoid unnecessary charges.

Negative Balance Increases: Understanding The Causes And Consequences

Negative balance increases, an indication of financial difficulty, demand prompt attention to curb escalating consequences. Understanding the causes and impacts can aid in developing effective rectification strategies and aligning financial practices.

- Insufficient Income: Low earnings can hinder meeting obligations.

- Excessive Spending: Uncontrolled expenses surpass income.

- Debt Accumulation: High-interest loans increase balances.

- Financial Mismanagement: Poor budgeting and investment decisions.

- Unexpected Expenses: Emergencies or repairs can strain budgets.

- Loss of Employment: Reduced income impacts financial stability.

Negative balance increases trigger a ripple effect of consequences, including hindered access to credit, increased interest charges, legal implications, and damage to personal finances. Addressing the underlying causes and seeking professional guidance can help mitigate these impacts and restore financial well-being. For example, increasing income streams, optimizing spending, and consolidating debt can stabilize financial situations.

Obesity Causes and Consequences Infographic for Overweight Stock Vector - Source www.dreamstime.com

Negative Balance Increases: Understanding The Causes And Consequences

Understanding the causes and consequences of negative balance increases is crucial for businesses and individuals alike. Negative balances can arise from various factors, including overspending, unexpected expenses, or insufficient income. It is essential to address negative balances promptly to prevent further financial strain.

Forex Negative Balance Protection by vasudevan kannan - Issuu - Source issuu.com

Negative balance increases can lead to late payment fees, increased interest charges, and damage to credit scores. For businesses, negative balances can disrupt cash flow and even threaten solvency. Individuals may face difficulty accessing credit, higher borrowing costs, and even legal consequences.

To mitigate the risks associated with negative balance increases, it is important to track expenses carefully, create a budget, and seek professional financial advice if necessary. By understanding the causes and consequences of negative balances, businesses and individuals can take proactive steps to manage their finances effectively and avoid potential financial pitfalls.

| Cause | Consequence |

|---|---|

| Overspending | Late payment fees, increased interest charges, damage to credit score |

| Unexpected expenses | Disrupted cash flow, difficulty accessing credit |

| Insufficient income | Higher borrowing costs, legal consequences |

Conclusion

Understanding the causes and consequences of negative balance increases is essential for financial stability. By tracking expenses, creating a budget, and seeking professional advice when needed, businesses and individuals can proactively manage their finances and avoid the negative impacts associated with negative balances.

Failure to address negative balances promptly can lead to severe financial consequences. It is important to prioritize financial literacy, develop sound financial habits, and seek support when necessary to ensure long-term financial well-being.