After doing some analysis, digging through the information, and putting together this guide, we can confidently say that this guide is the most comprehensive resource available on the internet for effortless tax compliance.

Key differences or Key takeaways:

Transition to main article topics

FAQ

This FAQ section provides answers to common questions regarding the comprehensive guide on effortless tax compliance. It aims to clarify misconceptions and address concerns, ensuring a smooth tax filing experience.

Question 1: What are the key benefits of effortless tax compliance?

Streamlined and efficient tax filing processes minimize errors and save time. It ensures accuracy, reducing the risk of audits and penalties. Moreover, effortless tax compliance provides peace of mind, eliminating the stress and anxiety associated with tax preparation.

Understanding The 1040 Form A Comprehensive Guide To Filing Taxes Excel - Source slidesdocs.com

Question 2: How can I make tax filing less overwhelming?

Employ user-friendly software and leverage online resources to simplify the process. Break down the task into smaller, manageable chunks, and seek professional guidance if needed. Planning and organizing tax-related documents throughout the year enhances efficiency and reduces the burden during tax season.

Question 3: What if I make a mistake on my tax return?

Timely detection and correction of errors are crucial. File an amended return to rectify any mistakes and minimize potential penalties. Seeking professional assistance from a tax advisor or accountant ensures accuracy and compliance.

Question 4: How can I stay updated on tax laws and regulations?

Stay informed by accessing the official website of the tax authority. Subscribe to newsletters or follow social media channels for updates. Attending workshops or seminars conducted by tax professionals can also provide valuable insights.

Question 5: What are the consequences of non-compliance with tax laws?

Failure to comply with tax obligations can result in hefty fines, penalties, and even criminal prosecution. It damages reputation, hinders business operations, and may lead to asset forfeiture. Ignorance of tax laws is not a valid excuse, hence the importance of seeking professional guidance.

Question 6: How can I prepare for a tax audit?

Proper record-keeping is paramount. Maintain organized and accessible financial documents, including receipts, invoices, and bank statements. Cooperate fully with the auditor, providing clear and accurate information. Seeking professional representation from a tax attorney or accountant can safeguard rights and ensure a smooth audit process.

Remember, tax compliance is not merely a legal obligation but also a responsible practice that contributes to the overall health and stability of the economy. By addressing these FAQs, we aim to empower individuals and businesses with the knowledge and tools necessary for effortless tax compliance.

For further in-depth guidance on tax filing and compliance, explore the comprehensive guide provided alongside this FAQ section.

Tips

Filing taxes need not be a daunting task. By systematically planning and organizing your finances, you can effortlessly ensure compliance with tax regulations while safeguarding your financial well-being. Explore the following tips to streamline your tax filing process and minimize potential complications.

Tip 1: Organize Your Financial Records

Maintaining a well-organized system for financial records is crucial. Gather all relevant documents, including receipts, invoices, bank statements, and investment records. Consider using a dedicated software or cloud storage service to securely store and categorize these documents for easy retrieval during tax preparation.

Tip 2: Understand Tax Deductions and Credits

Familiarize yourself with the various deductions and credits available to you. These provisions can significantly reduce your tax liability. Research tax codes, consult with a tax professional, or utilize online resources to identify applicable deductions and credits that align with your financial situation.

Tip 3: Seek Professional Assistance When Needed

If you encounter complexities or uncertainties in your tax situation, consider seeking guidance from a qualified tax professional. A tax expert can provide personalized advice, ensure compliance, optimize deductions, and represent you if necessary. Their expertise can alleviate stress and potential errors during the tax filing process.

Tip 4: Leverage Technology for Tax Preparation

Embrace the convenience of tax preparation software or online platforms. These tools can simplify the process by guiding you through each step, providing calculations, and flagging potential issues. Additionally, consider e-filing to expedite the filing process and ensure timely delivery to tax authorities.

Tip 5: File on Time and Avoid Penalties

To avoid late filing penalties and potential legal consequences, adhere to tax filing deadlines. Mark important dates on your calendar, and start preparing your taxes well in advance to allow ample time for thorough preparation and review. Timely filing ensures compliance and safeguards against unnecessary expenses.

Summary of key takeaways or benefits

By incorporating these tips into your tax filing strategy, you can streamline the process, maximize deductions and credits, minimize errors, and ensure timely compliance. Remember, tax regulations are subject to changes, so stay informed and consult Effortless Tax Compliance: A Comprehensive Guide To Filing Taxes for the most up-to-date information.

Transition to the article's conclusion

With proper planning and organization, tax filing can be a manageable task. Embrace these strategies to simplify your tax preparation, reduce stress, and ensure compliance. By staying informed and seeking professional assistance when necessary, you can navigate the tax system with confidence and safeguard your financial well-being.

Effortless Tax Compliance: A Comprehensive Guide To Filing Taxes

Filing taxes can be a daunting task, but it doesn't have to be. By understanding the essential aspects of tax compliance, you can make the process effortless. This comprehensive guide will explore six key aspects to help you navigate the complexities of tax filing with ease.

- Understanding Tax Laws: Know the tax laws and regulations that apply to your situation.

- Gather Necessary Documents: Collect all required tax documents, such as W-2s and 1099s.

- Choose the Right Filing Method: Determine the most suitable filing method for your needs, whether it's online, mail, or professional assistance.

- Maximize Deductions and Credits: Take advantage of allowable deductions and credits to reduce your tax liability.

- File on Time: Avoid penalties by submitting your tax return by the due date.

- Keep Records: Maintain accurate records of your tax-related documents for future reference.

Understanding these aspects can transform tax filing from a burden into a manageable task. By following the guidance provided in this guide, you can ensure effortless tax compliance, minimize your tax liability, and avoid any potential complications. Remember, tax laws and regulations can be complex, so if you encounter any difficulties, seeking professional assistance from a tax advisor is highly recommended.

Streamline Corporate Tax Registration: Your Go-To Guide for a Stress - Source intuitconsultancy.com

Effortless Tax Compliance: A Comprehensive Guide To Filing Taxes

"Effortless Tax Compliance: A Comprehensive Guide To Filing Taxes" provides a comprehensive overview for effortless tax compliance. It covers various tax-related topics, including tax preparation, tax filing, tax audits, and tax planning. The guide is a valuable resource for individuals and businesses alike, as it provides clear and concise information on how to comply with tax laws and regulations.

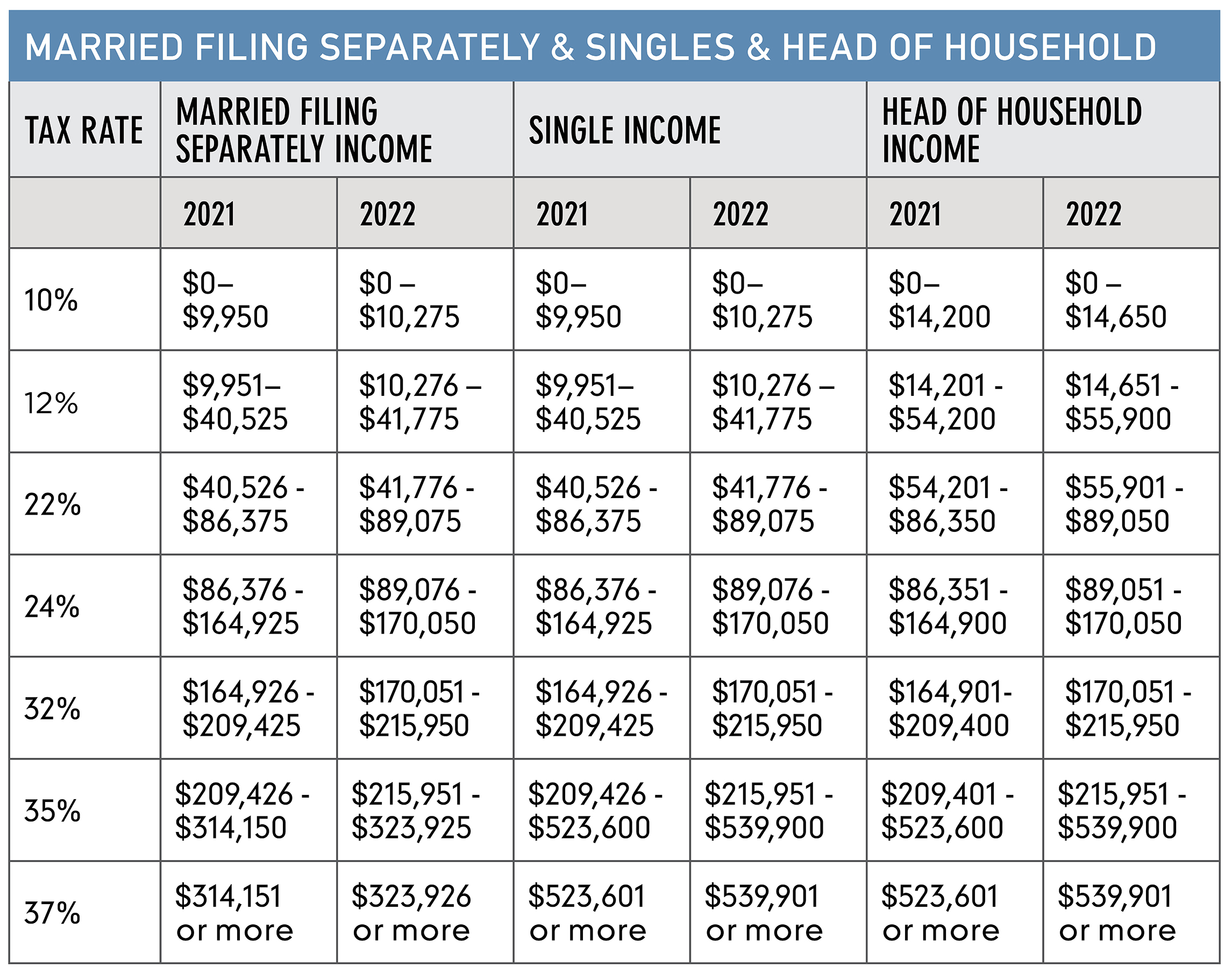

2025 Tax Brackets Married Filing Separately - Tedda Cathyleen - Source delasebetteann.pages.dev

The importance of understanding "Effortless Tax Compliance: A Comprehensive Guide To Filing Taxes" cannot be overstated. Taxes are a complex and ever-changing area of law, and it is important to stay up-to-date on the latest changes to ensure that you are compliant with all applicable tax laws. Failure to comply with tax laws can result in significant penalties, so it is important to have a clear understanding of your tax obligations.

This guide provides a valuable resource for individuals and businesses alike. It can help you to understand your tax obligations, and it can also help you to avoid costly mistakes. If you are interested in learning more about tax compliance, then this guide is a must-read.

| Topic | Description |

|---|---|

| Tax Preparation | This section covers the basics of tax preparation, including how to gather your tax documents, how to choose a tax preparer, and how to file your tax return. |

| Tax Filing | This section covers the different ways to file your tax return, including filing online, filing by mail, and filing with a tax preparer. |

| Tax Audits | This section covers what to do if you are audited by the IRS, including how to prepare for an audit and how to respond to an audit notice. |

| Tax Planning | This section covers how to plan for your taxes, including how to reduce your tax liability and how to save for retirement. |

Conclusion

"Effortless Tax Compliance: A Comprehensive Guide To Filing Taxes" is a valuable resource for individuals and businesses alike. It provides a comprehensive overview of tax compliance, and it can help you to understand your tax obligations and avoid costly mistakes. If you are interested in learning more about tax compliance, then this guide is a must-read.

By understanding the connection between "Effortless Tax Compliance: A Comprehensive Guide To Filing Taxes", you can ensure that you are complying with all applicable tax laws and regulations. This can help you to avoid costly penalties and ensure that you are paying your fair share of taxes.