Retirement planning is a crucial aspect of financial well-being, and securing a stable retirement income is paramount.

After extensive research and analysis, we have compiled this comprehensive guide to help individuals understand the importance of pension points and provide practical strategies for maximizing their accumulation.

Key Takeaways

| Maximizing Pension Points | Benefits |

|---|---|

| Accumulate pension points through contributions and work experience | Higher retirement income |

| Optimize income levels for higher pension point accrual | Improved financial security |

| Utilize government incentives and employer programs | Increased retirement savings |

Main Article Topics

FAQ

This FAQ section provides answers to frequently asked questions about maximizing pension points with Entgeltpunkte. Understanding these details is crucial for individuals seeking to secure their financial future during retirement.

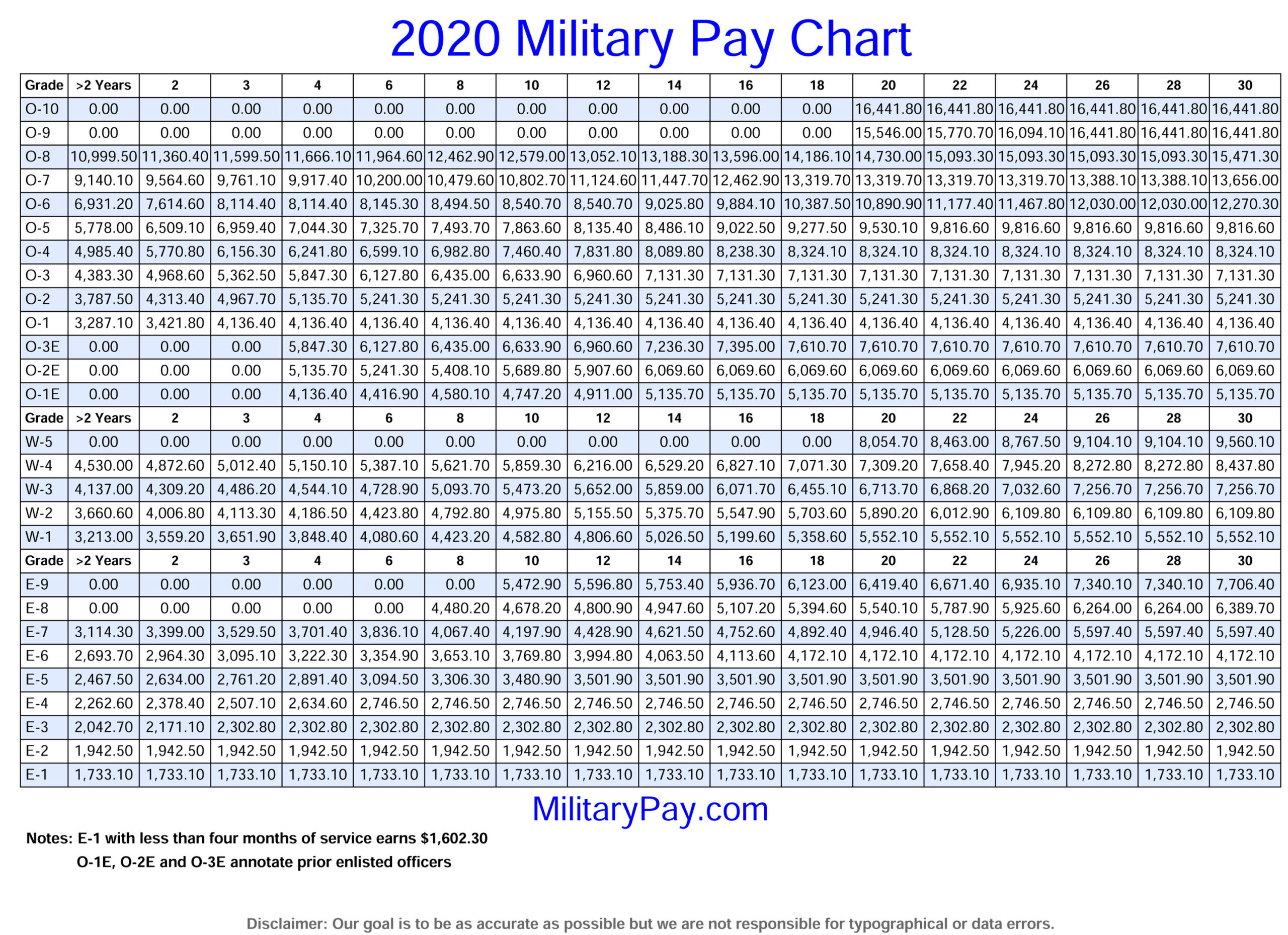

Military Retirement Pay Chart 2021 - Military Pay Chart 2021 - Source military-paychart.com

Question 1: What are Entgeltpunkte?

Entgeltpunkte are points earned throughout an individual's working life in Germany. These points are used to calculate the amount of pension benefits received upon retirement.

Question 2: How do I earn Entgeltpunkte?

Entgeltpunkte are earned based on the amount of income an individual receives from employment and self-employment. Higher income typically translates to more Entgeltpunkte.

Question 3: How many Entgeltpunkte do I need for a full pension?

The number of Entgeltpunkte required for a full pension varies depending on the year of retirement. Current estimates indicate that around 45 Entgeltpunkte are necessary.

Question 4: What happens if I have fewer Entgeltpunkte than needed?

Individuals with fewer Entgeltpunkte will receive a reduced pension. It is therefore advisable to maximize Entgeltpunkte throughout one's working life.

Question 5: Can I earn Entgeltpunkte after retirement?

No, it is not possible to earn Entgeltpunkte after retirement. All Entgeltpunkte must be earned during an individual's working life.

Question 6: How can I check my Entgeltpunkte?

Individuals can check their Entgeltpunkte by requesting a "Rentenauskunft" from the German Pension Fund (Deutsche Rentenversicherung). This document provides an overview of all earned Entgeltpunkte.

Understanding these key aspects of Entgeltpunkte is essential for individuals seeking to secure their financial well-being during retirement. Proper planning and informed decision-making can contribute significantly to achieving a comfortable and financially secure future.

Tips for Maximizing Pension Points

Gaining Earn Retirement Security: Maximize Your Pension Points With Entgeltpunkte through Entgeltpunkte is crucial for securing a comfortable retirement. Here are some tips to help you navigate the system:

Tip 1: Start Early

Every year of employment and contributions towards your pension increases your total Entgeltpunkte. Starting your career at a young age allows you to accumulate more points over time.

Tip 2: Choose High-Earning Employers

Your monthly salary directly impacts the number of Entgeltpunkte you earn. Seek employment with organizations that offer competitive compensation packages to maximize your earnings.

Tip 3: Maximize Working Hours

Working full-time and completing overtime can increase your pension contributions. Every additional hour worked contributes to your overall Entgeltpunkte.

Tip 4: Avoid Career Gaps

Continuous employment ensures a steady stream of pension contributions. Periods of unemployment or reduced hours can negatively impact your total Entgeltpunkte.

Tip 5: Explore Voluntary Contributions

If you have the means, consider making voluntary contributions to your pension plan. These contributions directly increase your Entgeltpunkte and can significantly boost your future retirement income.

Conclusion

Maximizing Entgeltpunkte is essential for securing a stable and comfortable retirement. By following these tips, you can increase your pension earnings and enjoy peace of mind in your golden years.

Earn Retirement Security: Maximize Your Pension Points With Entgeltpunkte

Ensuring retirement security requires careful planning and maximizing pension benefits. Entgeltpunkte, a crucial aspect of the German pension system, significantly impacts the amount of retirement income. Here are six key aspects to consider when maximizing pension points:

- Contribution level: Higher contributions result in more Entgeltpunkte.

- Years of employment: Extending the employment period increases the number of years for which contributions are made.

- Income level: Higher incomes lead to more contributions and higher Entgeltpunkte.

- Child-raising periods: Periods spent raising children are considered for Entgeltpunkte calculation.

- Pension scheme: Different pension schemes have varying rules for calculating Entgeltpunkte.

- Minimum income: A minimum income level is required to earn Entgeltpunkte.

By understanding these aspects, individuals can make informed decisions to maximize their Entgeltpunkte and secure a comfortable retirement. For instance, extending employment or increasing contributions, even in small increments, can significantly impact the total number of points earned. Additionally, utilizing benefits like child-raising credits and understanding the nuances of the pension scheme can further enhance retirement income.

Maximize Your Retirement Savings With The Help Of A Fee-only Financial - Source sahajmoney.com

Earn Retirement Security: Maximize Your Pension Points With Entgeltpunkte

Entgeltpunkte, or pension points, are a crucial component of Germany's statutory pension system. They determine the amount of pension benefits individuals receive upon retirement. By understanding the connection between Entgeltpunkte and retirement security, individuals can make informed decisions to maximize their future pension income.

How to Maximize Your Social Security Benefits — Vision Retirement - Source www.visionretirement.com

Each Entgeltpunkt represents a specific amount of pensionable income. The higher the number of Entgeltpunkte accumulated, the higher the pension entitlement. Therefore, it is essential to maximize Entgeltpunkte throughout one's working life.

There are several ways to increase Entgeltpunkte. One is to earn a higher income, as higher earnings result in more pension contributions. Another strategy is to extend the duration of employment, as this allows for more years of pension contributions and accrual of Entgeltpunkte.

Additionally, individuals can take advantage of certain government incentives, such as the "Riesterrente" or "Rüruprente" schemes. These private pension plans allow individuals to make additional pension contributions and receive tax benefits in return.

Maximizing Entgeltpunkte is a crucial step towards ensuring retirement security. By understanding the connection between Entgeltpunkte and pension benefits, individuals can make informed decisions and take necessary actions to secure a comfortable retirement.

Table: Key Insights

| Concept | Explanation |

|---|---|

| Entgeltpunkte | Pension points that determine retirement benefits |

| Maximizing Entgeltpunkte | Essential for securing a comfortable retirement |

| Strategies for Maximization | Higher income, longer employment, government incentives |

| Importance | Ensures financial stability and well-being in retirement |

Conclusion

Maximizing Entgeltpunkte is a vital component of retirement planning. By accumulating as many pension points as possible, individuals can ensure a secure and financially stable retirement. It is important to start planning early and consider various strategies to maximize Entgeltpunkte throughout one's working life.

In addition to maximizing Entgeltpunkte, it is also prudent to explore additional retirement savings options, such as private pension plans or investments. By taking a proactive approach to retirement planning, individuals can build a solid financial foundation for their future.